The total programme funding is EUR 31 million which is available to the residents in form of a loan.

The funding is intended for repairs of the public access areas of multi-apartment buildings and for improvements of the surrounding area, such as replacement of water pipes or roofs, improvement of heating systems, stairway repairs, replacement of windows and doors, repair of the elevator, road, pavement or parking lot construction, landscaping, construction of children’s playground or sports field, and other improvements of the public access area.

The programme is particularly important as the funding will be available for buildings that have previously been refused a loan by commercial banks. Furthermore, loans will be available for urgent repairs even if the building has not accumulated sufficient funds.

Loan for repairs of multi-apartment buildings and landscaping of the surrounding area:

*There is no minimum limit for the financing of ineligible costs under the multi-apartment building energy efficiency (MBEF) project;

The loan is intended for the following improvements of a multi-apartment building:

The loan is available if:

Support is provided as a grant of de minimis aid in accordance with Commission Regulation (EU) No 1407/2013 of 18 December 2013. Cabinet Regulation No. 481 “Conditions for the Support Programme for the Construction of Multi-Apartment Residential Buildings and the Improvement of Their Territories” of 6 July 2021 governing the programme.

“The vast majority of Latvia’s multi-apartment buildings were built before 1993, and they require renovation. Around 70% of Latvian buildings can be renovated in a cost-effective way. However, it requires cooperation between apartment owners, building administrators, and banks,” points out Edmunds Valantis, the State Secretary of the Ministry of Economics. “This newly introduced programme aims at facilitating the access to funding for the repairs of multi-apartment buildings and motivating the apartment owners to invest in the improvement of their property, including the public access areas. This programme is particularly important as the funding will be available for buildings that have previously been refused loans by commercial banks. Furthermore, credit will also be available for urgent repairs even if there are insufficient funds. It should be pointed out that this loan is particularly useful when interest rates are low.”

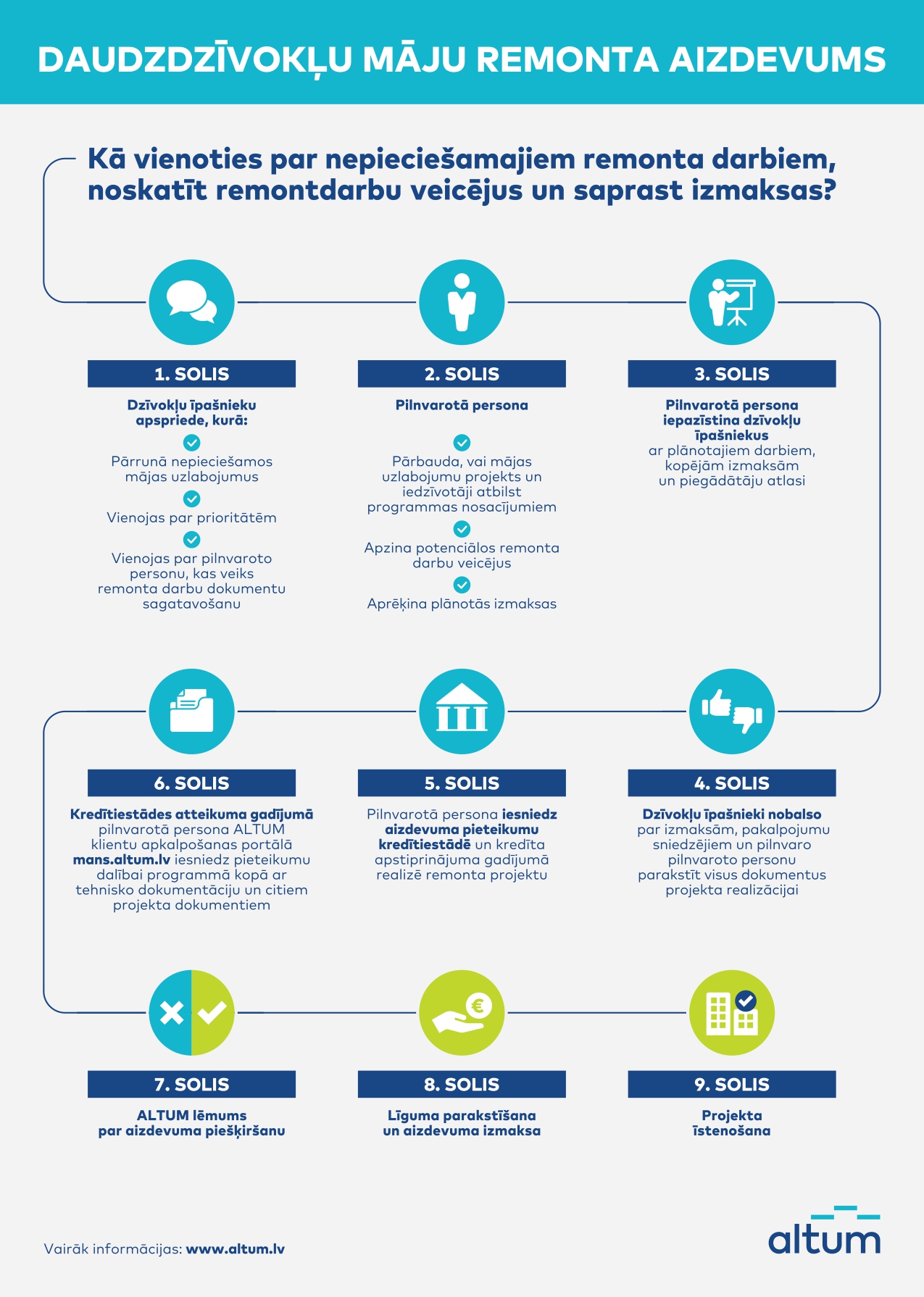

How to receive a loan for repair work?

The community of the apartment owners must agree on the necessary repairs and the priorities for the improvement of the public access areas and the surrounding territory, choose the authorised person who will represent the apartment owners’ interests, and set the procedures for the monitoring of the cash-flow of the project.

Once the estimated cost has been calculated, the authorised person selects the contractors. The decision on the necessary repairs, costs, and the selected contractors shall be deemed to have been made if the apartment owners representing more than half of all owners 50% +1 have voted “YES”, while for apartments subject to joint ownership, 100% of votes are required.

Expenses incurred during the development of the project, as well as the remuneration of the authorised person, if any, may be included in the total amount of the loan. To obtain a loan, you must first apply at a bank of your choice. If the bank rejects the application, you can apply to ALTUM to take up their loan offer.

The residents will repay the loan together with their monthly utility bills, which means that the amount of the loan will be included in their utility bills.

You can schedule an appointment with a specialist of “Rīgas namu pārvaldnieks” who will advise you on the programme: